I am pleased to be writing the inaugural blog post of Blockchain Advisors, LLC (BCA) and I hope you will find it informative. Our goal at BCA is to educate and assist our business and personal clients with adoption of crypto and blockchain technologies. I speak for the whole leadership team at BCA when I state that each of us ended up here as a result of a search for understanding as to what forces truly shape the world that we live in. Our intent in our blog posts is to keep our clients and associates up to date on very timely news but also to educate our audience on what brought us to this precarious point in the legacy financial system. This first blog post is in that later vein.

Seeing that a large portion of our life is spent at our job or while engaging in a career, the financial system that we all toil under is of paramount importance to our current state in life as well as our future. When we work we are sacrificing our present for our future. When we earn more than we spend we are either saving the remainder or investing it for the future. We are attempting to store up our economic energy to use at a later time. When we work or are performing services most of us think we are being paid “money” but in fact we are paid in “currency”. Then unfortunately many of us try to save in the currency we are paid as a trade for our life blood (time and energy).

The 6 characteristics of currency are:

- It is a medium of exchange – it is generally accepted and recognized as a trading instrument

- It is a unit of account – it has numbers on it

- It is portable – it can be moved around easily

- It is durable – doesn’t tear or degrade easily

- It is divisible – you can make change

- It is fungible – each unit is the same as the next unit/it is interchangeable

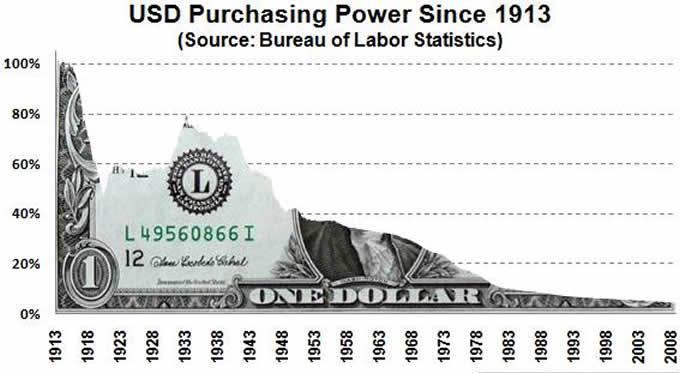

In order to be “money” you need to have the 6 characteristics above plus a very important one. It also needs to be a long-term store of value. The Federal Reserve Notes (FRNs) that are in all of our pockets do not have this characteristic. Below is a chart of the value of the US Dollar since 1913 when the Federal Reserve System was created.

Admittedly this chart is somewhat dated but the degradation of the dollar is even much worse today. Both because it is 14 years later and we have had massive inflation of the money supply since Covid was released on the world. If the US dollar had been a store of value we would not be in the dire economic position we are in today. The citizens of the United States and of most foreign countries have had their wealth, their economic energy, stolen from them in the most insidious manner and yet very few citizens recognize the source of their economic pain and duress.

In my 30 plus years of consulting with business owners, accountants and executives I remember exactly where I was standing and to whom I was speaking when he called the Federal Reserve Notes in his wallet “currency”. He did not call it “money.” One time in over 30 years! Wow! Many may think this difference in terms is a small nuance but it indicates to me the extent of the fraud that has been perpetuated on the unknowing masses. One person called what many people in the US call “money” by what it actually was, just “currency”. He was educated and enlightened in my opinion.

It is hard for good natured people to understand that the declining value of the US dollar is not an accident. By design it is how our system works. It was setup in that manner not for our benefit but for the benefit of the owners of the Federal Reserve System. We believe that many individuals are starting to realize that something is wrong with the legacy financial system, both in the United States and abroad. They know something is amiss but may not be able to put their finger on it. God opens people’s eyes differently and at different times.

Our eyes, thankfully, were opened long ago. Our goal is to provide education to our customers and associates and teach them one avenue as to how they can refuse to have their economic energy stolen by the legacy financial system. As a first step it is important to understand the concept of “currency” not being “money.” Here is a great hint: if the cost of printing a $100 note is the same as printing a $1 note then you are dealing with currency. The only difference is the specific arrangement of the ink on the paper.

Thankfully, because of the internet we have some really exceptional, free education available to us today. In reality, some of the education on our current financial predicament and the possible solutions take some time to study and understand. Regarding the topic of money versus currency as well as a history of money I found a series of videos years ago that I thought were well worth my time. These videos were produced by Mike Maloney in the 2011 to 2013 timeframe.

Remember that during that timeframe Bitcoin was just getting started and did not have the adoption that it has today. So when Mike talks about Gold & Silver just add Bitcoin, mentally, to the end of that statement.

The first video that discusses Currency vs. Money is here: Money vs Currency – Hidden Secrets Of Money Episode 1 – Mike Maloney

I would be interested in knowing what you think of this video or even the series once you have reviewed them. Were they informative for you?

Our next blog post in this series will be a discussion of the origins and purpose of the Federal Reserve System.

Until Then… Chris Carrigee, PE, CPA